your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

What are the advantages of E-Filing HVUT Form 2290 with TruckTax?

What information is required to File Form 2290 Online?

Only 3 Steps to File Form 2290 Online:

- 1. Business Name & Address

- 2. EIN (Employer Identification Number)

- 3. VIN (Vehicle Identification Number)

- 4. Taxable Gross Weight of Vehicle

- 5. First Used Month (FUM) of Vehicle

Click here to learn more about IRS HVUT Payment Methods

Looking for other HVUT Tax 2290 Forms?

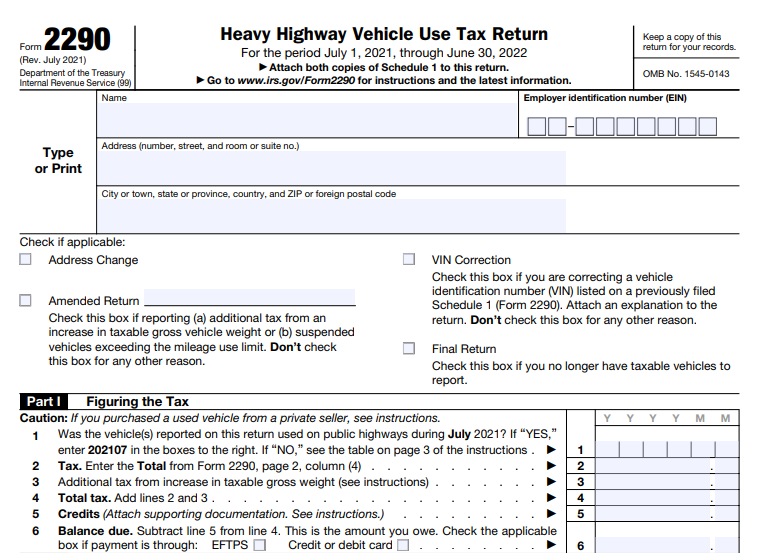

Form 2290 Amendments

VIN Corrections

Make corrections to your VIN, if you filed Form 2290 with the wrong VIN

Form 2290 Amendments

Increase in Taxable

Gross Weight

Report the IRS about the increase in the taxable gross weight of your truck.

Form 2290 Amendments

Low Mileage Exceeded

File this amendment if your suspended vehicle exceeds the mileage limit.

Form 8849

Claim Refund of HVUT Credits

File Form 8849 Schedule 6 and claim a refund of HVUT paid for Sold / Destroyed / Stolen vehicles.

Customer

Testimonials

“Wow! So much easier than sending in paper forms and waiting for the IRS to return the form that some years never come”.

- Chuck R, Iowa

Frequently Asked Questions

What is IRS HVUT Form 2290?

Form 2290 is an annual tax return filed by owners/drivers of heavy vehicles to calculate and pay the Heavy Vehicle Use Tax (HVUT). You are required to file Form 2290 for a vehicle if it has a taxable gross weight of over 55,000 pounds and is operated on the public highway.

When is due for Form 2290 filing?

The deadline to file your Form 2290 is the last day of the month following the First Used Month (FUM) of your vehicle. The FUM is the month you put your vehicle on the road for the first time during a tax year. The current tax year begins on July 1, 2023, and ends on June 30, 2024. For truckers who operate their vehicles in July, the deadline to file Form 2290 is on August 31.

What payment methods can I use to pay my Heavy Vehicle Use Tax?

The IRS offers the filers more than one way to pay their Heavy Vehicle Use Tax (HVUT). These are the payment methods available.

(i) Electronic Funds Withdrawal (EFW).

(ii) Electronic Federal Tax Payment System (EFTPS)

(iii) Check or Money Order.

(iv) Credit/Debit cards

How do I download my Form 2290 Schedule 1?

Once the IRS accepts your Form 2290, we will send your stamped Schedule 1 through email. You can also access your stamped Schedule 1 in the dashboard of your TruckTax account and download your Schedule 1 as many times as you want.